Personal Budget Tracker

The Benefits of a Personal Budget Tracker

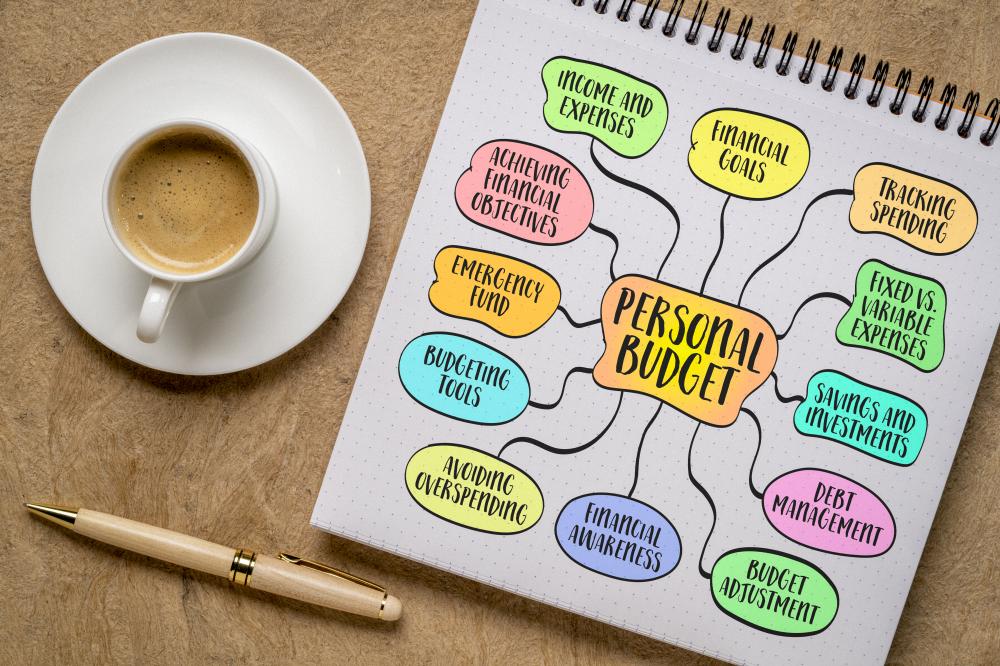

Managing personal finances can be a daunting task, especially when juggling multiple expenses, incomes, and future financial goals. A personal budget tracker is an essential tool that helps individuals monitor their spending habits and maintain financial discipline. By consolidating all financial information into a single platform, users gain better visibility of their financial standing, reducing the likelihood of missing bills or overspending. Moreover, these trackers provide valuable insights that can highlight areas where one might need to cut back, aiding in achieving long-term financial goals.

In today's fast-paced digital world, having a personal budget tracker can simplify the way you manage finances, reduce stress, and ultimately lead to a smarter approach to spending and saving. With various apps available, it has never been easier to find a tool that suits your particular financial needs and lifestyle. From students to professionals, everyone can benefit from using a personal budget tracker to streamline their financial responsibilities.

Key Features of CashFlowCast

CashFlowCast stands out with its robust set of features that cater to simplifying financial management for its users. One of the platform's most appealing aspects is its ability to manage bills efficiently. By allowing users to track bills in one centralized location, CashFlowCast ensures that no payment goes unnoticed or missed. This feature is particularly beneficial for individuals who manage multiple accounts across various financial institutions.

In addition to bill management, CashFlowCast offers an intuitive calendar view that provides a comprehensive overview of pending and due payments. This feature is instrumental in helping users visualize their cash flow and plan accordingly. The platform's forecasting capability is another remarkable feature, allowing users to project their financial status for up to five years into the future. Such foresight encourages better financial planning and empowers users to make informed financial decisions.

A timeless aspect of CashFlowCast is its cross-device compatibility, meaning users can manage their finances on Android, iPhone, and PC without hassle. This ensures that users have constant access to their financial data, fostering a seamless user experience that fits modern digital lifestyles.

How Personal Budget Trackers Impact Financial Health

Personal budget trackers have revolutionized the way people manage their money, offering substantial benefits for both short-term and long-term financial health. By facilitating meticulous tracking of income and expenses, individuals can gain a deeper understanding of their spending habits. This awareness is vital in fostering responsible financial behaviors and eliminating unnecessary expenses.

Tracking tools also promote accountability, encouraging users to stick to their budgets and monitor progress towards their financial goals. As a result, individuals are more likely to save money, reduce debt, and enhance their overall financial resilience. The disciplined approach instilled by a personal budget tracker often leads to improved credit scores and a more secure financial future.

Incorporating a personal budget tracker into one's financial routine can also alleviate anxiety associated with money management. By providing a clear picture of one's financial situation, these tools demystify the budgeting process and empower users to take control of their financial narrative, leading to increased confidence and peace of mind.

Choosing the Right Personal Budget Tracker

When it comes to selecting the ideal personal budget tracker, several factors should be considered to ensure it meets your unique financial needs. Compatibility with devices is a crucial aspect, as users require a platform that seamlessly integrates with their daily tech environment. A user-friendly interface is also important, making it easy to input, update, and track financial data.

Another vital factor is the range of features offered; individuals must decide if they need just basic expense tracking or more advanced options such as support for multiple currencies, customizable budget categories, or financial forecasting capabilities. Security should never be overlooked, as it's paramount to protect sensitive financial data from unauthorized access.

Moreover, budget trackers come in a variety of pricing models, from free versions offering limited features to premium subscriptions providing comprehensive functionalities. Prospective users should weigh the cost against the benefits to find a budget tracker that aligns with their financial goals and budget constraints.

Lastly, it's advisable to read reviews and perhaps test a few options with free trials to better understand the tools' capabilities and limitations. This approach ensures a well-informed decision, leading to a more personalized and effective budgeting experience.

Personal Experiences with Budget Tracking

Many users have shared their transformative experiences with personal budget trackers, often citing improved financial habits and reduced stress. For instance, Rachel, a young professional, found that by using CashFlowCast, she managed to cut down her monthly expenses by identifying unnecessary subscriptions she had forgotten about. The platform's notifications reminded her of upcoming bills, helping her avoid late fees and maintain her credit score.

Similarly, Tom, a freelance graphic designer, praised the forecasting feature of CashFlowCast, which enabled him to predict his cash flow during lean months. This foresight allowed him to adjust his spending patterns accordingly, ensuring he always had a buffer for unexpected expenses. Tom credits his improved financial management to the discipline instilled by regularly updating and reviewing his personal budget tracker.

The Underutilized Potential of Budget Trackers

Despite their immense benefits, many users fail to realize the full potential of personal budget trackers, often using them for merely recording expenses and incomes. However, these tools can also serve as powerful instruments for financial education and goal setting. By analyzing spending patterns and categorizing expenses, users can identify priorities and make informed decisions about their spending habits.

Budget trackers can also be used to set and track savings goals, whether for a major purchase, an emergency fund, or retirement planning. Visual charts and graphs available in many trackers offer motivating insights into one's progress, providing the encouragement needed to stay committed to financial objectives.

Exploring Advanced Features of Modern Budget Trackers

Modern personal budget trackers come packed with advanced features that go beyond basic expenditure recording. Integrations with banking systems allow automatic import of transactions, saving time and ensuring accuracy in data entry. Some apps offer artificial intelligence-driven insights that analyze user behavior to provide tailored financial advice, helping users maximize their savings potential.

Multi-platform accessibility is another advanced feature, allowing users to manage their finances regardless of their location. Enhanced security protocols, including biometric logins and two-factor authentication, assure users that their financial data remains secure. These innovations collectively elevate the user experience, making financial management more efficient and effective.

With features like categorization of transactions, budget setting across multiple accounts, and real-time updates, users can stay informed and proactive about their financial health. This level of detail encourages positive financial behavior and supports users in achieving long-term financial security.

CashFlowCast: A Step Towards Financial Empowerment

CashFlowCast offers a unique approach to financial management by combining simplicity with powerful tools. This platform aims to empower users by providing comprehensive budget tracking and forecasting functionalities at an affordable price. The ease of use, coupled with the platform's robust features, makes it an attractive option for individuals looking to take charge of their financial future.

An annual subscription of $24.95, including a 30-day free trial, grants users access to a rich suite of tools designed for optimal financial management. By using CashFlowCast, individuals can set up and track their bills, schedule payments, and view their payment history all in one place. Its affordability and intuitive design appeal to users seeking a streamlined approach to managing their finances.

Financial Forecasting with CashFlowCast

One of the defining features of CashFlowCast is its financial forecasting capability, allowing users to predict their earnings and expenditures far into the future. This feature is invaluable for those who want to grasp the long-term implications of their financial decisions. Equipped with this knowledge, users can adjust their financial strategies to align with their future goals, whether saving for a house, planning for retirement, or ensuring a stable financial safety net.

With financial forecasting, CashFlowCast users have the advantage of making preemptive adjustments to their budgets, preventing potential financial pitfalls. This proactive approach to budgeting exemplifies a modern, smart way of managing personal finances, demonstrating the tool's importance in today's financial landscape. Its utility extends beyond day-to-day management, providing a clear pathway to future financial stability.

How do you track a personal budget?

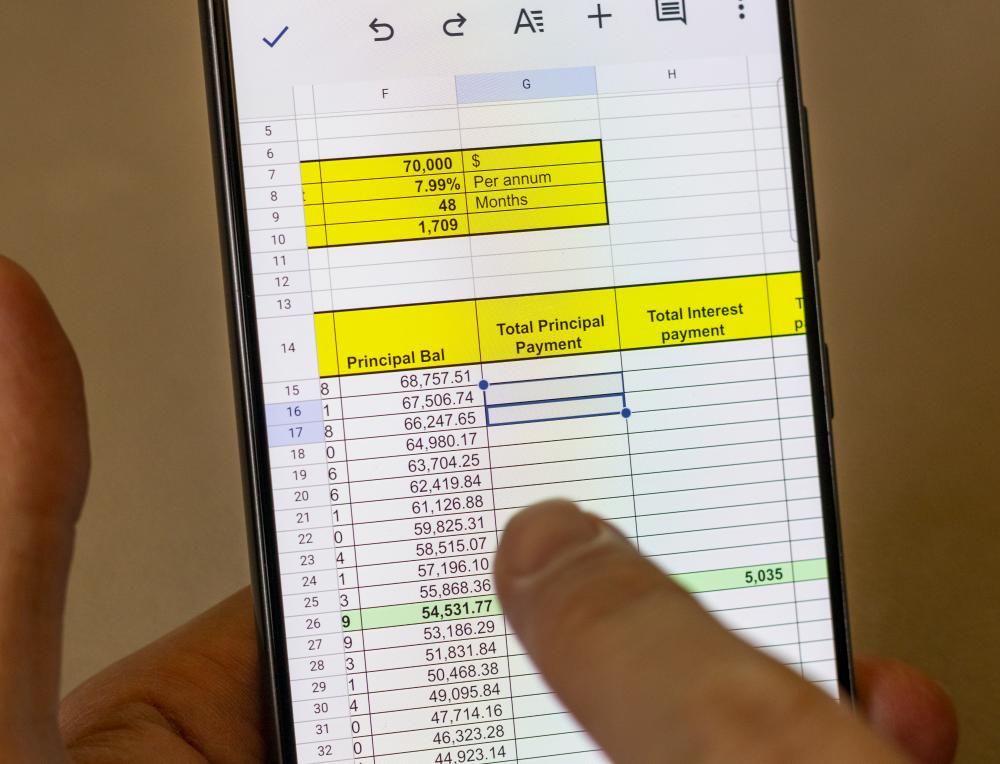

Tracking a personal budget can be done in several ways, but it generally involves recording your income and expenses to understand and manage your financial situation effectively. One practical approach is utilizing platforms like CashFlowCast, which allows you to centralize all your financial data, making it easy to visualize your cash flow. Begin by listing all your income sources and then categorize your expenses into fixed (like rent or mortgage) and variable (like dining out). Regularly update this information to reflect spending changes, and use the platform's forecasting tools to predict future financial trends. This practice ensures you are always informed about your financial health, allowing you to make necessary adjustments and stay on track with your financial goals. Have you ever tried using a digital tool for budgeting compared to manual methods like spreadsheets? How did your experience differ?

What is the 50/20/30 rule?

The 50/20/30 rule is a simple budgeting framework that helps individuals allocate their income into three main categories: needs, savings, and wants. According to this rule, 50% of your income should be directed towards needs, which include essentials like housing, utilities, and groceries. Next, 20% should be reserved for savings and debt repayment, emphasizing the importance of financial security and planning for the future. Finally, 30% is for wants, covering discretionary spending like entertainment, dining out, and hobbies. This method provides a balanced approach to budgeting that prioritizes both financial responsibilities and personal enjoyment. Have you considered how such a rule might fit into your financial planning, or are there other strategies you prefer for managing your budget?

What is the #1 budgeting app?

Choosing the "best" budgeting app can depend heavily on individual needs and preferences, but CashFlowCast has been praised for its comprehensive features and user-friendly design. It stands out with its powerful tools such as financial forecasting and seamless integration across various devices. Users appreciate its ability to centralize bill management, send reminders for upcoming payments, and provide a clear overview of financial responsibilities through an intuitive calendar view. Additionally, the financial forecasting capability up to five years into the future is invaluable for users who seek long-term financial clarity. Are you currently using any budgeting apps, and if so, what features do you find most beneficial?

What is the best free program to track personal finances?

For those looking to track personal finances without incurring costs, several free options are available, each with its own strengths. Programs like Mint offer comprehensive tracking and budgeting tools at no cost, allowing users to view all their financial accounts in one place. While CashFlowCast is a paid service, its free 30-day trial provides an opportunity to explore its robust features without commitment. During this period, users can experience features like bill management and financial forecasting, which might not be available in free apps. If you've explored both free and paid tools, what were the deciding factors in choosing your preferred budget tracker?

How can personal budget trackers improve financial health?

Personal budget trackers can significantly enhance financial health by providing real-time insights into spending habits and cash flow. Tools like CashFlowCast allow users to identify areas where they may be overspending, offering data-driven recommendations to optimize their financial decisions. By visualizing income against expenditures, users can set realistic budgets, track their progress towards financial goals, and make informed adjustments as necessary. Moreover, regular use of a budget tracker fosters financial discipline, which can lead to improved savings and debt reduction over time. Have you noticed any changes in your financial behavior since using a budget tracker?

Choosing the Right Personal Budget Tracker

Selecting a personal budget tracker that fits your needs involves considering factors like usability, device compatibility, and the range of features offered. It's essential to prioritize security, ensuring your financial data is protected with robust safeguards. CashFlowCast, for example, is compatible across various devices and offers intuitive features like financial forecasting and bill reminders, which can be crucial for effective budgeting. Understanding your specific financial goals and preferences can guide you in choosing a tool that matches your lifestyle. Have you tried different budget trackers before finding one that clicked, or are you still searching for the right fit?

What advanced features should I look for in modern budget trackers?

Modern budget trackers offer a range of advanced features that can enhance your financial management experience. Look for tools with financial forecasting capabilities, which allow you to project your financial situation into the future based on your current patterns. Integration with bank accounts for automatic transaction imports can save time and reduce manual error. Security features such as biometric logins and two-factor authentication ensure your data remains safe. CashFlowCast, for instance, provides multi-platform access and personalized insights, making it an attractive option for users seeking advanced financial management. Are there specific features you find indispensable in a budget tracker?

Resources

- Consumer Financial Protection Bureau - Official website for the Consumer Financial Protection Bureau, providing resources and information on personal finance management.

- MyMoney.gov - A U.S. government website dedicated to teaching Americans about financial basics and providing tools and resources for financial planning.

- Investor.gov - The U.S. Securities and Exchange Commission's website offering resources for investors, including tools for managing personal finances and investments.

- Consumer Reports - A non-profit organization providing unbiased product reviews and ratings to help consumers make informed purchasing decisions.

- National Foundation for Credit Counseling - A non-profit organization offering financial counseling and education to help individuals achieve financial stability.