Track Recurring Payments

Importance of Tracking Recurring Payments

For many people, the advent of subscription services has added a layer of convenience to daily life. However, as the number of these services increases, so does the complexity of managing them. From streaming platforms to gym memberships and even cloud storage, each service demands a recurring payment, often leaving users overwhelmed by the sheer number of transactions.

In my experience running CashFlowCast, I've seen how easily these payments can go unnoticed, leading to missed due dates and unnecessary fees. Taking control of one's financial landscape necessitates a system for managing these payments effectively.

Without a solid technique to track recurring payments, individuals risk financial bloopers that can affect budgeting and savings targets. The reality is, having a consolidated view of all recurring expenses empowers users to make informed financial decisions and stay ahead of potential budget pitfalls.

Tools and Technology

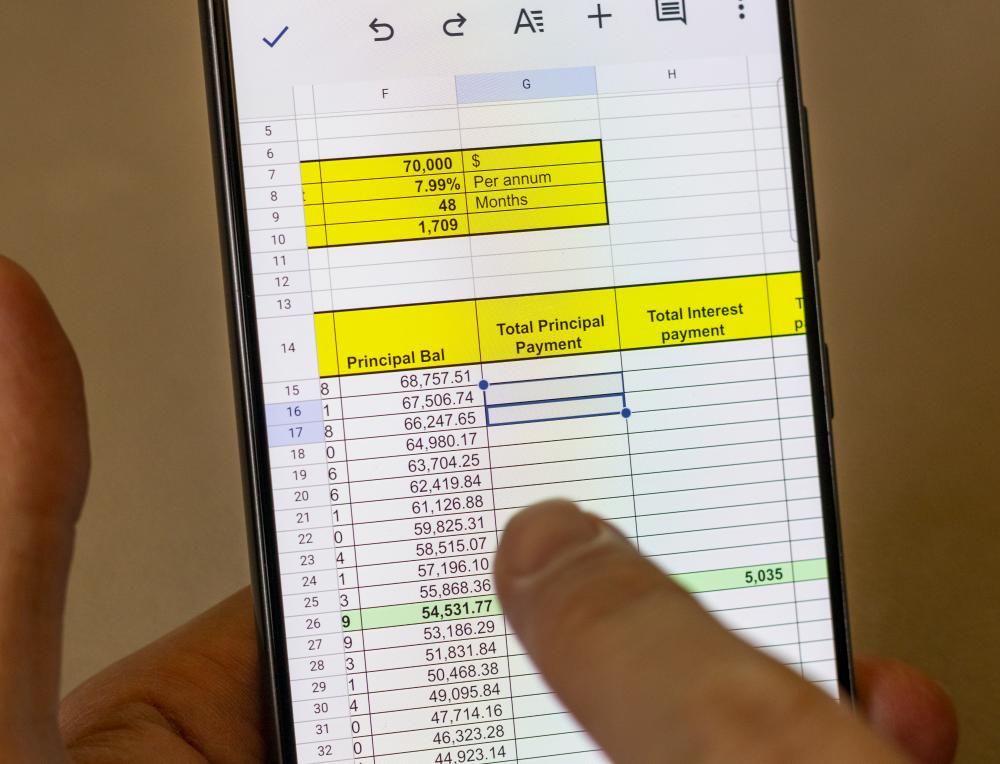

In the digital age, technology provides multiple solutions to keep tabs on your finances. At CashFlowCast, we've harnessed these innovations to create a platform that makes it easy for users to oversee their bills and forecast their finances. Our system is designed to help users seamlessly track recurring payments across various devices, ensuring that vital financial data is always at their fingertips.

Many tools, including ours, offer notification systems and visual aids like calendar views, simplifying the process of tracking payments. When my team conducted user interviews, a common theme was how visual timelines assist in understanding when bills are scheduled, providing greater clarity and reducing stress.

Streamlined Bill Management

Centralizing bill management can dramatically improve one's financial health. The key is to have a single point of access for all incoming and outgoing payments, which greatly reduces missed payments and late fees. For instance, CashFlowCast offers this through our comprehensive dashboard, where all scheduled payments can be seen at a glance.

Not only does this streamline the user experience, but it also reduces the need to juggle multiple apps and accounts, which can lead to confusion and oversight. By providing a single platform for financial management, we aim to simplify user interactions and foster better budgeting habits.

Forecasting Your Financial Future

Forecasting is a remarkable feature that serves as a cautionary guide, helping users visualize their financial trajectory. With CashFlowCast, users can project their financial standing years into the future, which is essential for long-term planning and investment decisions. It's not just about knowing when your next bill is due--it's about understanding the impact of these recurring payments over time.

I've spoken with many users who have shared how our forecasting tools have alleviated their anxiety about the future. Knowing how current payments will affect finances down the line gives users the confidence to make large financial decisions, like purchasing a home or saving for retirement.

This feature is especially invaluable for those involved in financial planning, offering a clear picture of how today's financial commitments will shape tomorrow's opportunities.

Customizing Your Financial Dashboard

Customization is a powerful tool in tracking recurring payments, allowing users to tailor financial data to their unique circumstances. At CashFlowCast, we understand that no two financial situations are identical, which is why we offer customizable dashboards that reflect personal priorities and needs.

From tag-based categorization to personalized alert settings, users can mold their financial overview to fit their lifestyle. The ability to adjust notification preferences and organize payments by importance or amount has proven invaluable for many of our users, providing a tailored experience that enhances control over finances.

Security and Reliability

In the realm of financial tech, security is paramount. Trust is the foundation upon which our relationship with our customers is built, ensuring that their data is protected with the highest standards in cybersecurity. CashFlowCast employs advanced encryption protocols to keep user information secure while providing reliable service across multiple platforms.

We recognize that financial data is sensitive, and our commitment to security reflects our dedication to safeguarding user privacy. Regular system updates and adherence to the latest tech standards mean our users can have peace of mind as they track recurring payments with confidence.

Getting Started with CashFlowCast

Beginning your journey towards financial clarity is straightforward with CashFlowCast. We offer a free 30-day trial, requiring no credit card details, allowing users to explore our features without commitment. This trial period provides ample time to experience our platform's full capabilities, from tracking bills to forecasting future financial scenarios.

Once users choose to continue with our service, the subscription is set at an affordable annual price, making it accessible for a wide range of users. Our user-friendly interface ensures that set-up is quick and efficient, allowing users to spend more time focusing on their financial goals rather than on complicated processes.

Personal Anecdotes and Insights

Having managed CashFlowCast and worked closely with numerous users, I've heard countless stories about the transformative power of tracking recurring payments. One user shared how centralizing her bills allowed her to pinpoint and eliminate unnecessary subscriptions, saving her hundreds annually. Another user found peace of mind by finally having a clear picture of his family's financial commitments.

These stories illustrate the real-life impact of efficient bill management. Users often report a sense of relief and newfound control over their finances, providing the motivation needed to stay on top of payments and manage future expenses strategically.

Practical Tips and Tricks

To effectively track recurring payments, I recommend adopting these practical strategies: set up automatic notifications for due dates, regularly review and update your subscriptions, and categorize payments by necessity. Additionally, consider using forecasting tools to better understand long-term financial commitments and their potential impact on savings and investments.

- Leverage notification systems to stay informed about upcoming payments.

- Conduct periodic audits of your subscriptions to identify unnecessary costs.

- Utilize categorization methods for better visibility and management.

Addressing Common Challenges

As with any financial tool, challenges may arise in the process of tracking recurring payments. These can include difficulty in maintaining an accurate database of subscriptions or managing multiple payment methods. At CashFlowCast, we strive to address these issues through our FAQ section and active customer support, ensuring users have access to the help they need when they need it.

Our community forums also provide a valuable resource, filled with tips and advice from fellow users who have successfully navigated and resolved similar challenges. The collective knowledge of our user base contributes significantly to the overall experience and success of tracking payments effectively.

How do I track monthly recurring payments?

Tracking monthly recurring payments can be quite straightforward with the right tools and mindset. At CashFlowCast, we have designed our platform to give you a central dashboard where all your recurring payments are tracked. It's as simple as inputting your subscriptions, their amounts, and due dates. Our system will do the heavy lifting by providing a calendar view and sending timely notifications, so you never miss a payment. Think of it like having a personal assistant who reminds you when it's time to pay your bills. This not only helps in staying organized but also in preventing late fees and keeping your credit score healthy. Have you considered setting up alerts for your important payments to stay ahead of them?

How do I see all recurring transactions?

Using CashFlowCast, viewing all your recurring transactions is seamless. Our platform consolidates all your financial commitments in one place, offering a comprehensive overview through our financial dashboard. You can categorize and personalize this dashboard to reflect your specific needs, ensuring that every transaction is accounted for. With our intuitive interface, you can easily scroll through and analyze your spending patterns. This transparency allows for smarter budgeting and a clearer understanding of where your money goes each month. It's empowering to know exactly what commitments you have coming up. Would you like to explore ways to streamline your financial habits further?

Is there a site that keeps track of subscriptions?

Absolutely, and CashFlowCast is one of the best options for this purpose. Our platform is dedicated to simplifying your financial life by tracking all your subscriptions and recurring payments. Whether it's your streaming services, gym memberships, or online tools, we provide a centralized hub for managing them all. Our calendar view and forecasting capabilities enable you to visualize not just the present commitments but also how they impact your future finances. It's all about staying one step ahead, and CashFlowCast makes that possible with ease and efficiency. Have you ever realized how much subscriptions could add up to if not monitored closely?

How do I find and stop recurring payments?

Finding and stopping recurring payments is often a matter of being proactive about monitoring your finances. CashFlowCast offers tools to help you identify all your active subscriptions. Once logged into our system, you can review your list of transactions and spot anything that doesn't seem necessary anymore. From there, it's a matter of navigating to the service provider's site to cancel the subscription. Regular audits of your subscriptions through CashFlowCast can help you identify and halt any unnecessary payments, ultimately saving you money. Have you thought about scheduling a routine check-up on your subscriptions to avoid unwanted charges?

How does forecasting financial futures help in bill management?

Forecasting your financial future is like having a map for your finances. With CashFlowCast, we provide tools that allow you to project your financial trajectory based on your current recurring bills and income. This feature is crucial for long-term planning, as it enables you to see potential outcomes of your financial decisions. By having a clear picture of how today's commitments affect tomorrow's possibilities, you can make informed choices about spending, saving, and investing. It's a strategic approach that turns bill management from a reactive task to a proactive endeavor. Would you be interested in knowing how forecasting could influence your long-term financial goals?

What are the security measures in place to protect financial data?

Security is a top priority at CashFlowCast. We employ advanced encryption protocols to safeguard your financial information, ensuring that your data is always protected. Our services are designed around trust, providing peace of mind through regular system updates and adherence to cutting-edge cybersecurity standards. Knowing your data is secure allows you to focus on managing your finances without worry. Trust in this protection enables you to embrace digital financial management tools confidently. Are there any specific security concerns you'd like to discuss when it comes to financial data protection?

Can customization of the dashboard enhance financial management?

Absolutely, customization is a powerful feature that can significantly enhance your financial management experience. With CashFlowCast, you can tailor your dashboard to meet your unique financial needs, ensuring that the information most relevant to you is front and center. By organizing your financial data according to your lifestyle and preferences, you gain better control and clarity over your finances. This personalization can lead to more effective budgeting and a greater sense of financial empowerment. Have you ever personalized a financial tool, and did it make a difference in how you managed your money?

Resources

- Consumer Financial Protection Bureau - The official website of the Consumer Financial Protection Bureau, providing resources and information on managing finances effectively.

- Investor.gov - A resource from the U.S. Securities and Exchange Commission offering tools and information to help individuals make informed investment decisions.

- USA.gov Money - A comprehensive resource from the U.S. government covering various aspects of managing money, including budgeting and saving tips.

- AnnualCreditReport.com - The only authorized website to get free credit reports as required by federal law, allowing individuals to monitor their credit history.

- Internal Revenue Service - The official website of the IRS, providing tax information, tools, and resources for individuals and businesses.